Spain is quickly turning into a hotspot for digital nomads and entrepreneurs, thanks to its amazing weather, great lifestyle, and relatively low cost of living. But you might be wondering—what’s it really like to be self-employed in Spain?

Dealing with the Spanish tax system can feel tricky, especially if you're not familiar with it. Spain has a reputation for being a bureaucratic maze—and honestly, it's not hard to see why.

In this post, we'll tackle some of the most common questions about being self-employed in Spain (known as autónomo), like taxes, Social Security, what a gestor does, VAT, and how expense deductions work.

What taxes will I have to pay as self-employed in Spain?

1. Income Tax

If you’re an autónomo in Spain, you’ll need to pay income tax, known as IRPF (Impuesto sobre la Renta de las Personas Físicas). You might’ve seen headlines claiming Spain is a tax haven for digital nomads with flat-rate taxes, but that’s not quite true for most people. Check out our blog to see why.

For most people earning “average” amounts—close to the minimum salary needed for the visa—you’ll likely be on the same tax system as other self-employed workers in Spain. Taxes are progressive, ranging from 19% to 47% depending on your income.

Want to know how much tax you will pay? You can get an estimate by using this calculator.

Spain’s tax year runs from January to December, and you’ll need to file a quarterly tax return plus a year-end summary (or la declaración de la renta in Spanish). These are known as Modelo 130 and Modelo 100. Submitting these forms is mandatory—even if you didn’t make any income during a quarter.

2. Social Security

In Spain, social security contributions are a must for freelancers. These payments give you access to healthcare and a state pension down the line.

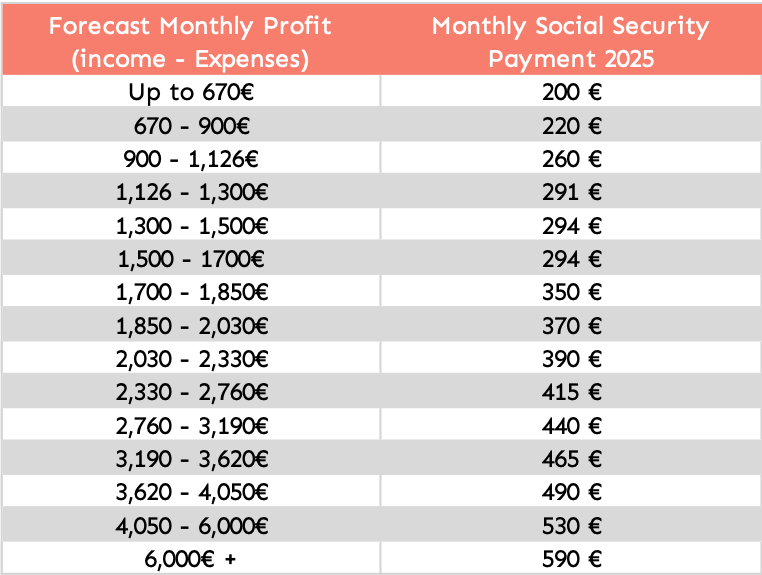

Good news for new freelancers: there is a flat rate of approximately €87 per month for your first 12 months. After that, you’ll switch to a sliding scale where your contributions are based on how much you earn each month. You’ll need to estimate your income and let the General Treasury of Social Security know so they can calculate your payments. Don’t worry—you (or your gestor) can adjust this amount up to 6 times a year if needed.

The minimum contribution in 2025 is €200 per month, based on a monthly net profit of up to €670, while the maximum is €590 per month for earners with a monthly net profit of €6,000 or more.

Do I need to hire someone to help with taxes?

If you're used to doing your own taxes back home, things work a bit differently in Spain. Most autónomos (freelancers) hire a gestor—a pro who handles Spain's tricky admin and bureaucracy for you. It's not mandatory, but it can make your life a whole lot easier, especially if your Spanish isn’t great or you’re not familiar with the tax system here.

A lot of our clients use MyTaxes, and we definitely recommend checking them out.

Will I need to charge VAT (IVA)?

Like any other business, freelancers need to charge 21% Impuesto sobre el Valor Añadido (IVA), or value-added tax, on top of each invoice. While the standard IVA rate is 21%, some goods and services benefit from reduced rates of 10% or even 4%.

If you're offering digital services to consumers in other EU countries, VAT rules can get a bit tricky because of the 'place of supply' rules. In these cases, you might need to apply the VAT rate of your customer’s country instead.

The good news? If your clients are outside the EU, you generally don’t have to add VAT to your invoices. This is especially handy for Digital Nomad visa holders, most of whom work with clients based outside the EU.

Can I deduct expenses?

As an autónomo, you can deduct business-related expenses and any VAT you've already paid from your taxable income.

Most self-employed workers get an annual flat allowance for hard-to-justify expenses, like the part of your electricity or internet bills used for a home office. This allowance is the lower of 7% of your profit or 2,000€.

Beyond that, deductible expenses need to be directly tied to your business activity and backed up with proper invoices and receipts.

If you're a self-employed digital nomad, common deductible expenses might include office supplies, business travel, professional services, a portion of your home office utilities (based on its size), and even meals with clients (under certain conditions).

What other deductions are available?

If you're a Spanish tax resident, you’re entitled to a basic personal allowance of at least €5,550, which can increase if you have a dependent spouse, kids, are over 65, or have a disability.

On top of that, autónomos can take advantage of several deductions to lower their tax bill. Here are a few examples:

Social security payments

In Spain, unlike places like the UK, your social security contributions are tax-deductible.

Private health insurance

You can deduct the cost of private health insurance for yourself, your partner, and any kids under 25 who live at home, up to €500 per person.

20% profit deduction for new autónomos

New autónomos can claim a 20% deduction on profits during their first two profitable years. There are two conditions:

- The deduction only applies to the first €100,000 of profits. Anything above that isn’t eligible.

- More than 50% of your income cannot come from a previous employer.

Get in touch with us today to apply for the Digital Nomad Visa!

0 comments