Although Spain's new Digital Nomad Visa was introduced in December 2022 as part of the new Startup Law, it's still not clear how things will work in terms of taxes.

The internet is full of conflicting information, with some sources claiming that digital nomads will pay a 15% flat rate of tax and that Spain will be a new tax haven. If only this were true!

The reality is, there are many good reasons to move to Spain - i.e. the weather, lifestyle & beaches – but to pay less tax is not one of them!

(It's also NOT the country you want to move to if you want to do less admin and deal with less bureaucracy, but that's a whole other post..)

Spain is a high tax country, with income tax rates rising as high as 47%, something which isn't great for attracting new talent and innovation – this is exactly why the new Startup law has been created.

What does the Startup Law actually say about taxes?

Very little.

Although the new law specifically mentions digital nomads (the hope is that they will 'contribute to activate consumption, enrich local talent and generate a network and value opportunities for other professionals'), the main focus of the law is on companies rather than employees or freelancers.

The law does mention a 15% flat rate of tax but this is for companies only. It also refers to a 24% flat rate for the employees of these companies but it's still unclear if and how this will apply to digital nomads.

Will I have to pay tax in more than one country?

No. What we do know is that Spain has a double tax treaty with many countries, including the UK and USA, so you should not have to pay tax on the same income in two different countries.

What is the Beckham Law?

The 24% flat-rate tax regime is known colloquially as the Beckham Law because the footballer David Beckham was one of the first to take advantage of it.

Rather than paying a progressive tax rate which rises close to 50% on his worldwide income as well as having the obligation to pay wealth tax on his multiple mansions, Beckham instead opted to be taxed as a non-resident, paying a flat 24% tax rate on his employment earnings from Real Madrid.

Ironically, the regime was later amended to exclude professional sports players, but it is now being adapted to include those who come to Spain as a result of the Startup Law.

How will the 24% tax regime work?

It's important to know that the 24% tax regime will not be automatic for digital nomads: you will have to make an application to the tax agency after coming to live in Spain and it will be up to them to decide if you qualify.

Before the new Startup law was published, only employees and company administrators with a shareholding of less than 25% who were allowed to take advantage of the Beckham regime. The self-employed were specifically excluded.

The new law amends the Beckham regime so that some self-employed workers can take advantage of it, but not many will qualify unfortunately.

Only the self-employed who carry out an activity classified as 'entrepreneurial' i.e. one that is of an innovative nature with special economic interest for Spain, can use the 24% tax regime. It's important to note that 'a favourable report from the competent body of the General State Administration' is needed in order to qualify.

The good news is, the Startup Law opens up the Beckham tax regime to those who come to Spain to work remotely for their overseas employer.

The employee's spouse, children aged under 25 (or over if disabled) and the parent of their children (if not married) can also benefit, provided they meet the requirements set out in the law. This is good news, especially in those cases where the spouse does not work and receives rental or investment income from abroad.

Will the 24% tax regime be right for everyone?

No. The majority of digital nomads who earn close to the minimum salary necessary to get the visa would end up paying more tax under the Beckham law tax regime.

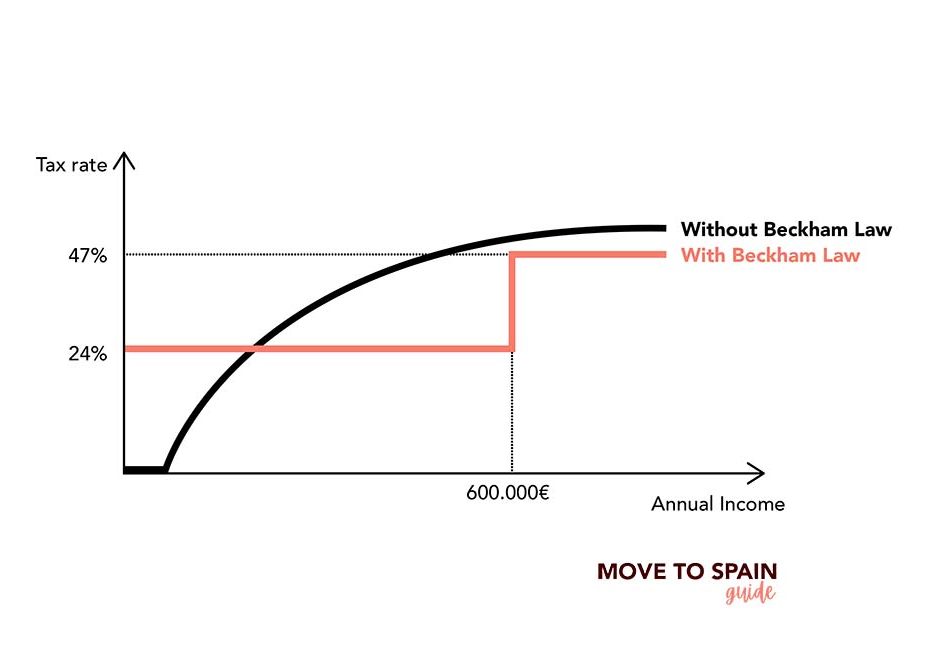

This is best explained with a graph. At the lower end of annual income, the average rate of tax paid is less without the Beckham Law tax regime. This is because regular Spanish tax residents have a personal allowance and starting rate of 19% while those on the Beckham regime do not: the 24% tax-rate starts from the first €1 of income.

The personal allowance varies depending on your age, whether you have dependants or a disability but in general terms, if your annual income is below approximately €40,000, you would probably pay more tax on the Beckham law regime.

On the other hand, if you have higher income, non-working income (i.e. from investments or capital gains) from abroad or total assets worth more than €700,000, you probably will want to consider the Beckham Law tax regime, but in this case it would be important to get advice before moving to Spain.

How much tax would I pay without the Beckham law regime?

Assuming that you continue to be an employee or self-employed in your home country, you'll continue to pay the same as you pay now, except once a year you would have to complete a Spanish tax return and pay any extra tax due to Spain.

It's difficult to say how much tax you would pay in Spain in a blog post as every autonomous community has slightly different rates, but here is a general guide of 2022 rates:

- Up to €12,450: 19%

- €12,450–€20,200: 24%

- €20,200–€35,200: 30%

- €35,200–€60,000: 37%

- €60,000–€300,000: 45%

- More than €300,000: 47%

Note that these are progressive rates, so you'd pay 19% on the first €12,450, then 24% on anything above €12,450 up to €20,200 for example.

There is also a personal allowance which starts at €5,550 but varies depending on your age/dependants/disabilities and various other deductions so please just use the above rates as a general guide.

What about Social Security?

Of course, income tax isn't the only tax that an employed worker must pay. In Spain, employees pay around 6% of their salary as social security, with their employer paying almost 30%.

As for the self-employed, for the first year you will pay a flat fee of 80 euros per month (reimbursed by the government if you are in Madrid, Andalusia or Murcia) and then in 2024, between 225 and 530 euros per month, depending on how much you earn.

Conclusion

Although the media have jumped upon the so-called tax advantages that digital nomads will have under the Startup Law, the reality is that most of those coming to Spain with an income close to the threshold required for the visa will stick to paying tax at normal Spanish rates.

Want to keep up with the latest on the Spanish Digital Nomad visa?

Join our Facebook group - we only publish information from government sources or direct personal experience.

0 comments