If you’ve been scrolling through social media lately, you’ve probably seen the buzz (and maybe a bit of panic) about Spain’s proposed social security fees for self-employed workers, or autónomos. Initially, some seriously high figures were thrown around – high earners might've been looking at paying up to €1,200 a month. But thankfully, the government's since changed its tune, and the increases are much more sensible now.

Even with this backtracking, a lot of people are wondering - why are Spanish autónomo fees so high compared to other countries, and what do you really get for your money? Let’s break it down and take a closer look.

The Background

To understand why Spanish autónomos pay so much, let’s break down the key factors:

1. Spain Has A Generous State Pension

A staggering 85 - 90% of Spain’s Social Security budget is allocated to state pensions, which are significantly more generous than in many other countries. The maximum state pension in Spain is more than three times higher than that of the UK, for example. As a result, only 45% of Spanish workers rely on private pensions, compared to 74% in the UK. However, this generous state provision places significant strain on the social security system.

2. The Self-Employed Aren't The Only Ones Contributing A Lot

Spanish employees effectively pay 38% of their salary as social security, although it is mostly a hidden cost. Employers pay 32% of employee wages as social security contributions and it can be argued that this cost is indirectly passed on to employees through reduced salaries. On top of this, employees directly contribute around 6% of their earnings.

Before 2022, the self-employed (autónomos) had the flexibility to choose their level of contributions. The majority of Spain’s 3 million autónomos opted for the minimum contribution (less than 300€ per month, regardless of income). As is the case in most countries with a state pension, the less you contribute, the lower your future pension will be, so this posed a societal risk: millions of retirees with insufficient pensions could place a heavy burden on public resources.

3. Spain's Pension System Needs More Workers

Spain’s social security system works on a “pay-as-you-go” model, meaning today’s workers are funding the pensions of current retirees. With an aging population, the ratio of workers to retirees is shrinking. Currently, it’s estimated that 2.32 workers are needed to fund a single pension. This imbalance, combined with EU pressure to ensure the system’s sustainability, has made reform unavoidable.

The 2022 Reforms

To address these challenges, the Spanish government introduced a new contribution system for the self-employed based on real net income through the Royal Decree-Law 13/2022. The reform was the result of extensive negotiations between the government, social partners (e.g., CEOE, CCOO, UGT), and self-employed organizations (e.g., ATA, UPTA, UATAE).

The new system, which came into effect on January 1, 2023, aims to ensure fairer contributions and better future pensions for autónomos. It is being implemented gradually, with reviews every three years to adjust and refine the contribution brackets.

What Are The Rates for 2026?

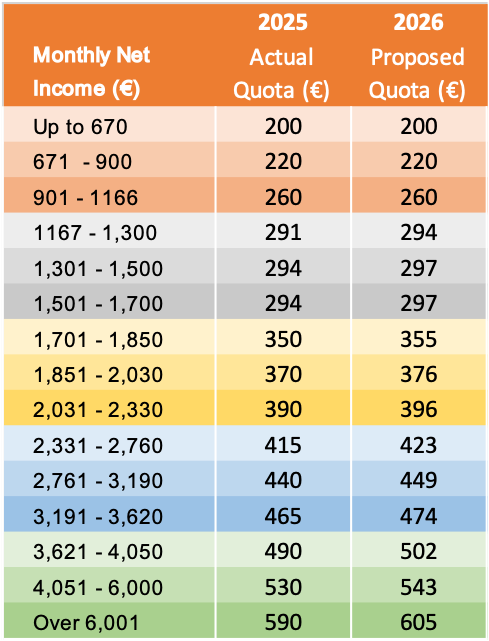

Here are the proposed new quotas (compared to the current 2025 rates):

Remember that these fees are based on your predicted net income (i.e. your earnings less your costs).

Also:

- You can switch your "base" up to 6 times a year.

- If you pick a level that's too low, you might face an adjustment at the end of the year—possibly with interest.

- These are the minimum contributions you need to make, but in some cases (like if you're retiring soon or planning a family), it could make sense to contribute more.

What exactly does this mean for the average Digital Nomad Visa Holder?

The minimum income for the Digital Nomad Residency is €2,763 per month. Self-employed social security quotas are based on net income (after deducting costs), but to keep things simple, let’s ignore costs and break down how much a digital nomad earning €2,763 per month with 0 costs would actually pay:

- Starter Rate: In your first year, you’ll pay just €87/month.

- From Year 2 onwards:

- 2025: €440/month

- 2026: Projected €449/month

Remember that these payments are tax-deductible, softening the blow by reducing your taxable income.

What Do You Get in Return?

It’s easy to focus on the costs, but here’s what your contributions buy you as an autónomo in Spain:

- Universal public healthcare for you and your family.

- A robust state pension, possibly transportable back to your home country.

- Income support if you’re sick or injured.

- Paid maternity/paternity leave and improved unemployment benefits.

- Disability support if you’re unable to work.

In short, you are relocating to a country with a robust benefits system.

What If You Don't Plan To Retire In Spain?

If you’re not planning to stay in Spain long enough to benefit from its state pension, don’t worry - you may not lose out. Spain has social security agreements with many countries, allowing you to combine contributions from multiple systems. This means you can still benefit from what you pay into Spain’s system, even if you move on.

So, what if your country doesn't have a social security agreement for pensions? Well, just remember that Spain offers an amazing lifestyle, top-notch healthcare, and you might even save some money on things like food, wine, and education fees.

Let MyTaxes Handle The Numbers For You

If you’re self-employed in Spain, navigating these changes can feel overwhelming. That’s where MyTaxes comes in. They are here to simplify your tax and social security obligations, so you can focus on what you do best—running your business.

MyTaxes are a gestoría with a difference. Created by digital nomads for digital nomads, we understand the challenges of navigating Spanish taxes when starting a new life abroad.

0 comments