Modelo 790 is a form used in Spain for the payment of fees associated with various administrative procedures. This document, also known as the "Tasa Modelo 790," is used to pay charges to public bodies for certain services, usually related to bureaucratic procedures.

The form is used in a variety of contexts, such as applying for Spanish citizenship, requesting a criminal record check, or other administrative procedures. There are different versions (or codigos) of the Modelo 790, each designed for a specific type of fee or payment. For instance, Modelo 790 Codigo 012 is commonly used for matters related to immigration and residency.

When you fill out a Modelo 790, you generally need to specify the reason for the fee payment, and then take the completed form to a bank to make the payment. You usually get a receipt or proof of payment, which you may need to present as part of your administrative procedure.

Which Modelo 790 code do I need?

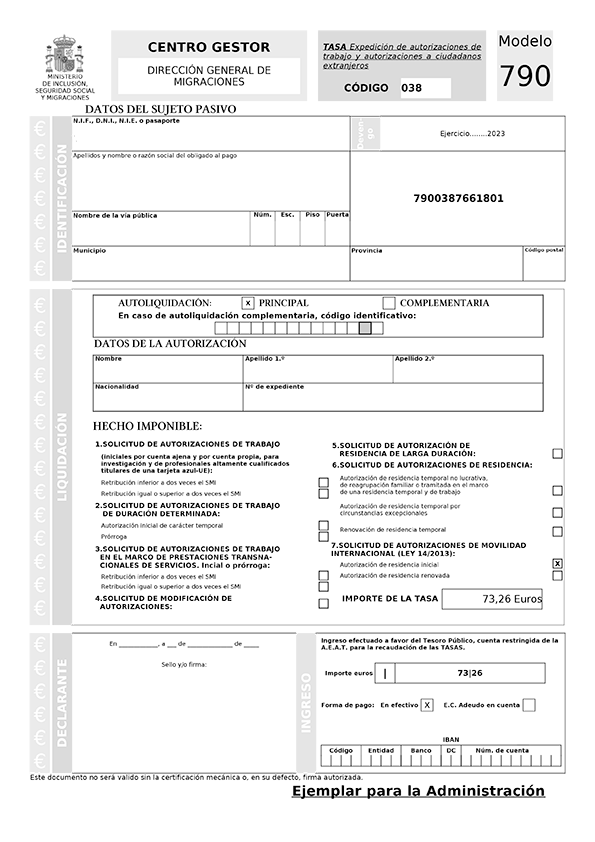

For the purpose of the Digital Nomad Visa you will need the Modelo 790 código 038.

What you'll need

- A Digital Certificate or Cl@ve

- a Spanish bank account (with IBAN code beginning with ES)

Instructions

- Fill out form 790 (link) on screen (digital certificate or cl@ve needed).

- In the 2nd section, tick the box 'principal'

- In the 3rd section, fill out your name and surname (leave the other boxes blank)

- In the section 'Hecho Imponible', tick the following box: 7. SOLICITUD DE AUTORIZACIONES DE MOVILIDAD INTERNACIONAL (LEY 14/2013): Autorización de residencia inicial

- Check that the figure of 73,26 euros appears in the box 'IMPORTE DE LA TASA'

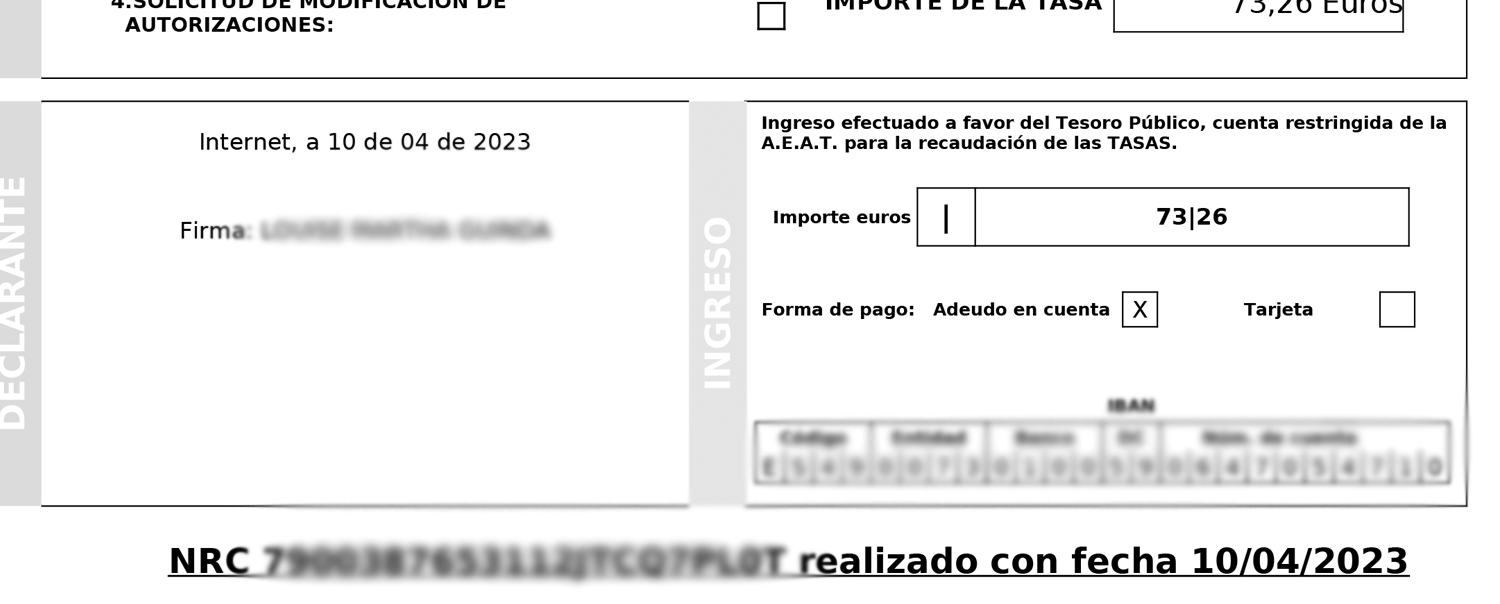

- In the bottom right section, tick the box 'Adeudo en cuenta'

- Enter your Spanish bank account IBAN

- Click the middle button 'Realizar por Telemático'

- On the next screen, press the button to confirm

- The payment will go through instantly and you'll be presented with a PDF receipt. Save the PDF and be sure to make a note of the NRC code as this is what is needed for the visa application.

0 comments