Game-changer for U.S. W2 employees: it seems that the Spanish Digital Nomad Visa (DNV) is now attainable!

Until recently, the U.S. Social Security Administration (SSA) required a Spanish company address for Certificates of Coverage (CoCs), effectively blocking U.S. digital nomads from the DNV since working for a Spanish company disqualifies applicants.

However, it seems that the 2024 U.S.-Spain social security agreement (effective 2025, full text pending public release) has shifted the landscape. We’ve seen CoCs issued with Spanish home addresses, and reliable sources confirm the UGE (Unidad de Grandes Empresas y Colectivos Estratégicos) now accepts these for DNV applications.

This guide details the CoC application process for W2 employees and self-employed individuals, explains why the CoC is rarely viable for self-employed applicants or business owners (e.g., S corporation owners), and provides key steps to secure the DNV.

Overview of the Spanish Digital Nomad Visa

Introduced under Spain’s 2023 Startup Act, the DNV allows non-EU citizens, including Americans, to live and work remotely in Spain for up to five years—initially granted for three years, with a two-year renewal option. To qualify, applicants must meet requirements such as a minimum monthly income of €2,763 (2025) for a single person, private health insurance, a clean criminal record, and compliance with social security obligations (i.e. a Certificate of Coverage from the US or a pledge to register to pay Spanish Social Security).

See the full list of requirements here

Role of the U.S. Certificate of Coverage

A U.S. Certificate of Coverage, issued by the SSA, verifies that an individual is covered under the U.S. social security system, potentially exempting them from Spanish social security contributions. Historically, CoCs haven't covered remote working, creating hurdles for digital nomads. Though the full 2024 U.S.-Spain social security agreement (effective 2025) remains unpublished, it appears to now include remote workers, with the UGE accepting CoCs listing home addresses for W2 employees, expanding access and significantly cutting U.S. applicants’ social security costs.

Eligibility for a U.S. Certificate of Coverage

To obtain a CoC under the U.S.-Spain totalization agreement, applicants must meet specific criteria:

- W2 Employees: Must be employed by a U.S.-based company and working remotely in Spain for a period not exceeding five years (extendable by an additional two years in exceptional cases). The CoC should list the employee’s home address, as per the UGE’s updated guidance, making it a viable option for W2 employees.

- Self-Employed Individuals: Must maintain primary business operations in the U.S. The SSA typically interprets “primary business operations” as meaning the core of your business activities—such as client base, revenue generation, or operational hub—remains in the U.S. For this reason, the CoC is likely to benefit only a small number of self-employed individuals, as most plan to establish a long-term base in Spain.

Special Considerations for Business Owners

Company owners face unique challenges when applying for the DNV. Under Spanish law, individuals who own and control a registered company are classified as self-employed (autónomos), regardless of their U.S. business structure. We advise against applying for the DNV as an employee if you own over 25% of a company as this can lead to significant complications:

- Misalignment with Spanish Law: Under Spanish law, if you own a significant share (usually over 25%) in a company, you are considered to have control over the business. This control makes you ineligible to legally classify as an "employee" for the purpose of Spanish tax and social security systems. Claiming employee status when you own the business (e.g., as the sole shareholder of an S corporation) may raise red flags, as it could be seen as misrepresenting your work status to avoid Spanish social security obligations.

- SSA Scrutiny: The SSA may question your eligibility for a CoC as an employee if you are the owner of the business. For example, S corporation owners often pay themselves a salary as employees for tax purposes, but the SSA may view this as self-employment under the totalization agreement, especially if your business operations are not clearly U.S.-based.

- Risk of Rejection: If the UGE detects that you are a business owner applying as an employee, your CoC may be deemed invalid, jeopardizing your DNV application. This could result in delays or the need to reapply as self-employed, requiring registration with Spain’s social security system.

- Practical Challenges for S Corporation Owners: If you’re running an S-Corp and plan to live in Spain long-term, maintaining “primary business operations” in the U.S. can be difficult. For instance, if your clients are global or you manage operations from Spain, the SSA may argue that your business is no longer U.S.-centric, disqualifying you from a CoC. In such cases, registering as an autónomo in Spain may be the only viable option, despite the higher costs.

Key Considerations for Applicants

Several factors require careful attention:

- Tax Obligations: The CoC exempts social security contributions but not income tax. Residing in Spain for over 183 days during a calendar year establishes tax residency. Some W2s can benefit from the Beckham Law’s 24% flat tax rate on income up to €600,000.

- Non-Spanish Work Requirement: The DNV mandates that employment or clients be primarily outside Spain, with Spanish-sourced self-employment income capped at 20%.

- Alternative Options: If a CoC can't be obtained in time for the move, the main option is to apply as self-employed, including a pledge to register for Spanish Social security once approved. There is also a less-popular option for the applicant's company to register to pay them through Spanish payroll.

Step-by-Step Guide to Apply for a U.S. Certificate of Coverage

Obtaining a U.S. Certificate of Coverage (CoC) is a critical step for eligible W2 employees and some self-employed individuals applying for the DNV Spanish visa. Below is a detailed guide on how to apply for a CoC through the Social Security Administration (SSA):

STEP 1: Gather Required Documentation

- For W2 Employees: Your employer typically submits a Certificate of Coverage Request. You’ll need to provide:

- Your full name, Social Security number, and Spanish home address.

- Employer details, including the U.S. company’s name, address, and EIN (Employer Identification Number).

- A copy of your employment contract or letter from your employer confirming your remote work arrangement in Spain and the expected duration (not exceeding five years).

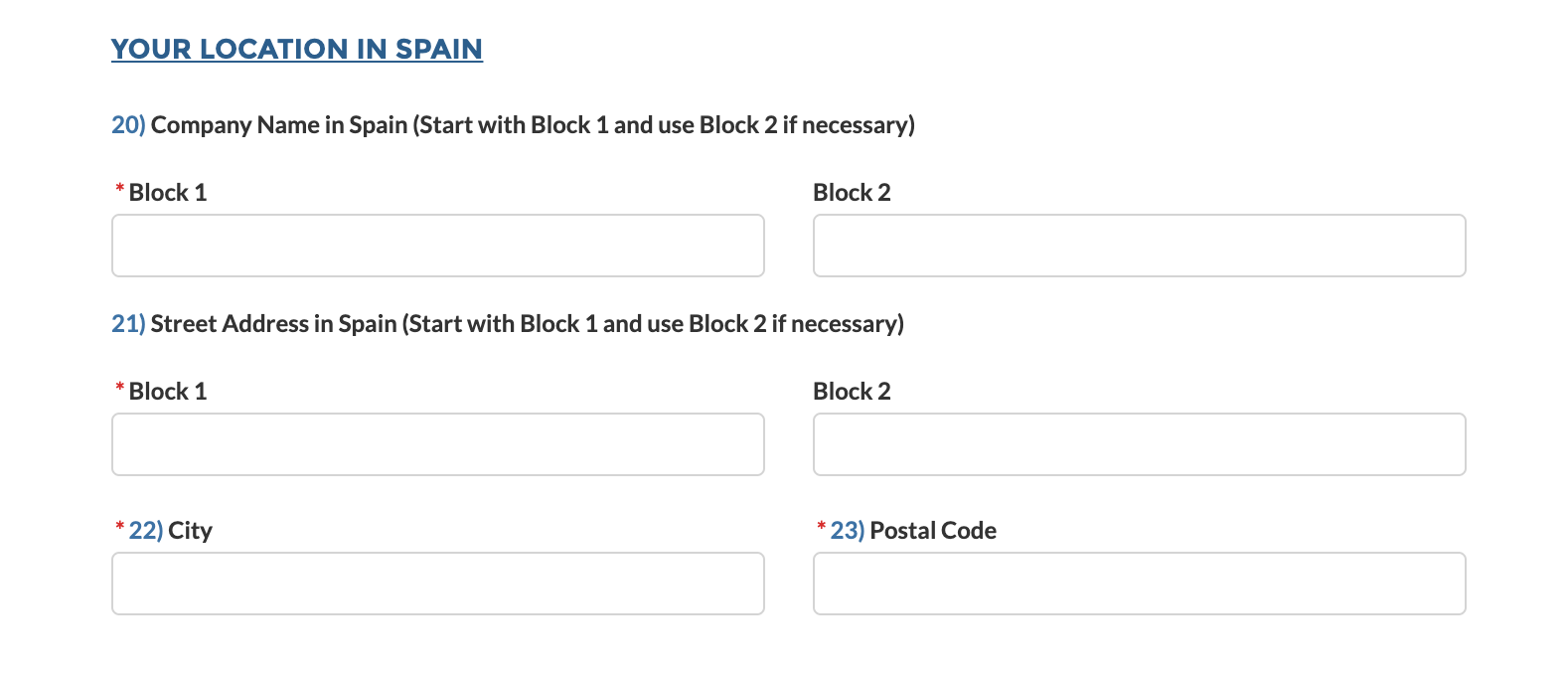

**Note**: As shown in the screenshot below, the SSA’s CoC application form has not been updated and still requests a Spanish company name and address for your location in Spain, despite recent instances of the SSA accepting home addresses.

- For Self-Employed Individuals: You must provide evidence of U.S.-based business operations, such as:

- U.S. business registration documents (e.g., LLC or S corporation filings).

- Recent U.S. tax returns (e.g., Schedule C or Form 1120S) showing self-employment income and Social Security contributions.

- Proof of U.S.-based clients or operations (e.g., contracts, invoices, or bank statements).

- A statement detailing your work arrangement in Spain and how your business remains U.S.-centric.

**Note**: We have no confirmed reports of the UGE accepting a U.S. Certificate of Coverage (CoC) for self-employed individuals (although it should be possible in theory, as the UGE has accepted at least one UK A1 certificate for a self-employed person). We advise against pursuing this route for self-employed applicants, especially for long-term stays, due to significant tax residency risks and the SSA’s strict U.S.-based business operation requirements.

STEP 2: Submit the CoC Application

- Applications are submitted through the SSA’s Office of Earnings and International Operations (OEIO) through the following methods:

- Online

- Mail: Social Security Administration, Office of Earnings and International Operations, P.O. Box 17775, Baltimore, MD 21235-7775, USA.

- Fax: 410-966-1861.

- For employees, your employer typically submits the request, but you should coordinate to ensure the home address is listed on the CoC.

- For self-employed individuals, submit the application yourself, including all required documentation.

- Clearly state that the CoC is for the U.S.-Spain totalization agreement and your intent to work remotely in Spain under the DNV.

Processing Timeline:

- The SSA typically takes 4–8 weeks to process CoC requests, though complex cases (e.g., self-employed applicants) may take longer. Start the process well in advance of your DNV application to avoid delays.

- Follow up with the SSA if you don’t receive confirmation within the expected timeframe.

STEP 3: Receive and Verify the CoC

- Once approved, the SSA will issue the CoC, which will specify your coverage under the U.S. social security system and the duration (up to five years).

- Verify that the CoC lists your home address (for W2 employees) or U.S. business details (for self-employed) and covers the intended period of your DNV stay.

- Ensure the document is complete and legible, as the UGE will scrutinize it during the DNV application process.

Seek Professional Assistance

Move To Spain Guide provides expert immigration support and connects you with trusted tax advisory services to streamline your Digital Nomad Visa application process.

Our team of experts can:

- Guide you through the DNV application, ensuring compliance with Spanish regulations.

- Provide a referral for tailored advice on tax implications, including the Beckham Law and U.S.-Spain double taxation treaty.

Contact Move To Spain Guide for personalized support or to schedule a consultation.

Conclusion

The UGE’s acceptance of home-address CoCs and the 2024 U.S.-Spain social security agreement mark a significant opportunity for U.S. W2 employees to secure the Spanish DNV. Given the complexities of tax and immigration regulations, consult a Spanish immigration professional such as Move To Spain Guide to verify requirements and ensure a seamless application process. Spain’s vibrant culture and top-tier digital nomad infrastructure await!

Disclaimer: Immigration and social security regulations are subject to change. Always confirm the latest requirements before applying.

0 comments